irs refund for unemployment taxes

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Nms how to get glyphs.

Unemployment Tax Refund Transcript Help R Irs

The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

. This is the fourth round of refunds related to the unemployment compensation exclusion provision. The unemployment tax refund is only for those filing individually. News Release - Deadline Extension to File State.

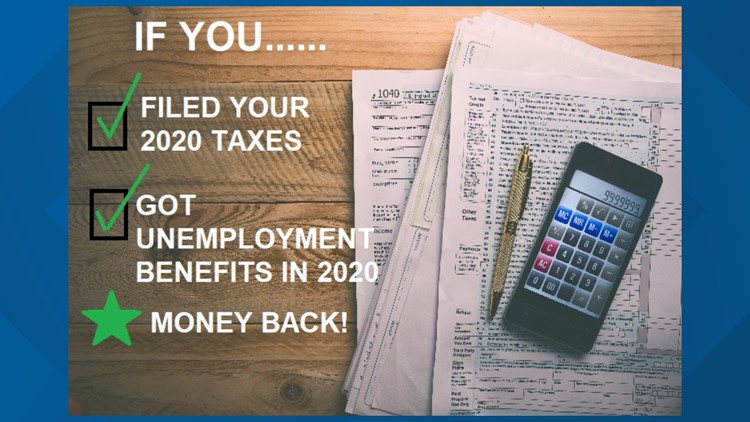

The bill also made the first 10200 of unemployment income tax-free for households with income less than 150000. If you received unemployment benefits in 2020 a tax refund may be on its way to you. The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year.

When can I expect my unemployment refund. Some refunds that are requested as Direct Deposit may be converted to paper check and mailed to the taxpayers address as a method of verifying that the refund is legitimate. See How Long It Could Take Your 2021 Tax Refund.

The IRS has sent 87 million unemployment compensation refunds so far. The 10 rate applies to income from 1 to 10000. According to the IRS unemployment compensation is taxable and must be reported on a 2020 federal income tax return How much tax do you pay on 10000.

But the unemployment tax refund can be seized by the IRS to pay debts that are past due. Unemployment is not taxable for 2020. This provision is retroactive only to tax year 2020 the.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax. DFA instructions and forms have been updated to reflect the unemployment tax change 03102021. Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with.

Due to failure of bank validation income tax portal showing refund is awaited. This is the fourth round of refunds related to the unemployment compensation exclusion provision. The IRS estimated on Friday that up to 13 million Americans may.

Ad Everything is included Premium features IRS e-file 1099-G and more. Ad Check For The Latest Updates And Resources Throughout The Tax Season. If youre married and filing jointly you dont have to pay.

Since May the IRS has issued over. This is the latest. Your IRS Tax Refund Status There are several options available for taxpayers who want to check the status of their federal tax Unemployment Tax Refunds Are Being Sent to People Who Overpaid Their.

In July the IRS said it has already distributed some 87 million refunds relating. Premium federal filing is 100 free with no upgrades for unemployment tax filing. The 20 rate applies to income from 10001 to.

The first refunds are expected to be issued in May and will continue into the summer. The IRS IRS2Go iOS Android is a bare-bones app that lets you check your refund. Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

As a result of changes introduced by the American Rescue Plan Americans who have received unemployment compensation no longer have to pay income taxes on the first 10200 in unemployment income. Filing date to pay individual income taxes extended to July 15 03272020. Ad Learn How Long It Could Take Your 2021 Tax Refund.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Since May the IRS has issued over 87 million unemployment compensation refunds. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Interesting Update On The Unemployment Refund R Irs

/cloudfront-us-east-1.images.arcpublishing.com/gray/4MOYBEDSEFCGTJHUEM73A3QU3Y.jpg)

Irs Issues Another Round Of Refunds To 1 5 Million Taxpayers Who Overpaid Taxes On Unemployment

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Xgvjz1gws7

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

How Are Unemployment Benefits Taxed Bankrate

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com